Life Of Tenants

Ten Things Government Could Do To Improve Life For Tenants

With elections looming in both NSW and Federally, most parties are bringing out policies which they think will appeal to tenants. Fair enough, tenants represent something like 40% of the population, possibly more in certain seats. Many of the policies I have read include such things as: ruling out No Fault Terminations or; limiting the level or frequency of rent increase, will no doubt appeal to many tenants. They may not however appeal to landlords who represent an equally large section of the voting public.

I have put my thinking cap on and I have come up with 10 ideas, which I feel will have far greater impact on the lives of all tenants.

- Ensure rent increases meet market value. There is a push by some to restrict rent increases to CPI. Whilst the housing index no doubt flows into the CPI calculations, the rental market has its own set of supply and demand forces. If the supply of housing falls below demand, rents increase. Landlords will be encouraged into the market in order to take advantage of higher rents. Market pressures will be brought back into balance. Rent increases will stall. At the moment rents are falling due to an over supply of properties in the rental market. This was brought about by a 5-year property boom, which was fuelled by investors buying into the market. By placing any price restriction on any market, you remove the essential market mechanism. Think back to what happened in the wool industry when a floor price was in place. A CPI price restriction will at certain times discourage new investors in to the market and could encourage some existing investors to leave; thereby exacerbating the shortage of available properties. This is exactly what happened in the bad old days of protected tenancies after WWII. Not only did the pool of private rental properties dry up, public housing had to increase to fill the gap and existing properties were maintained at a minimal level. The answer is to establish a register of rent increases via the Rental Bond Board’s, Rental Bonds Online (RBOL) Service. These figures could be monitored and made available to the tenants, real estate agents and the public.

- Ensure tenants have access to solar generated power by establishing Strata Titled Solar Farms located in rural areas. Tenants or other strata unit owners, could buy an entitlement into the Solar Strata Plan in order to subsidize their power costs. Tenants or owner occupiers of units would be eligible to government rebates or interest free loans as may exist from government to government.

- Only allow negative gearing and capital gains benefits on new properties. This will have the long-term effect of increasing the pool of newer homes available for rent and lower the average age of rental properties; thereby increasing the quality of facilities available to tenants. This is similar to, removing old cars off our roads, with the resulting affect we now have a much younger fleet of cars; which are safer, more comfortable and more fuel efficient than older vehicles.

- Place a mandatory age limit on properties, which can be leased. Tenants are often left with no choice but to lease properties, which do not meet current standards. For example: We live in a modern society with a high dependence on electrical appliances. Units built prior to the mid 1970’s only have 32 amps of power available. After the mid-70’s newer buildings have 63 amps supplied. Putting this in context, a 50 litre hot water system draws 15 amps, add to this an oven at 10 amps and 5 amps for each electric hot plate; and 16-20 amps for all power points (a portable AC unit generally draws about 10 amps). It is not hard to see why in early winter, tenants in older units experience inconvenient blackouts. Similarly, many balcony hand rails, fire safety, ceiling insulation do not meet current acceptable standards. A mandatory 50-year rule should be introduced. Properties older than 50-years need to be completely refurbished to current standards. They would need to be certified before they can re-enter the rental market.

- Make Owners Corporations subject to the Residential Tenancy Act. As any tenant or property manager will tell you (and NCAT members) getting Owners Corporations and Strata Managers to do anything which involves resolving a tenancy issue is near on impossible. For example: a garage door frame needs repair. The responsi9bility of the owners corporation. The owner, tenant and property manager are at the mercy of Strata Managers and Owners Corporations to decide in what time frame this might be completed. As the Owners Corporation also represent the landlord owners of a building, it only makes sense that Owners Corporations should be subject to the Residential Tenancy Act

- Introduce a pet bond. Many tenants want to have a pet. Tenants are often prevented from doing so because of justifiable fears of landlords and property managers. Pets of the potential damage to flooring, walls and other soft furnishings. Many landlord insurance companies now include a pet clause, which covers damage by pets. The next step is to introduce a pet bond, which would be sufficient to cover the potential cost of replacing a depreciated value of some of these items. Thereby placing some of the onus of care on the person wanting to keep a pet.

- Improve the educational requirements of all Real Estate Agents and reintroduce a minimum 2-year work experience rule for Licensees. This is an old issue for many in the industry. Successive governments have reduced the educational requirements of entering the industry. They have also removed the requirement of a minimum 2-year work experience prior to becoming a Licensee. The rational has been that making entry into the industry easier will increase competition. The result has been to reduced the knowledge and experience level of the industry.

- Require Landlords to complete an annual online educational course. There are many landlords who choose to go it alone without the assistance of a real estate agent. Equally, there are many landlords who use a real estate agent but ignorant their advice. Requiring landlords to complete an online CPD style course will keep them abreast of their obligations.

- Clarify the rules around sub-letting and mandate that sub-tenant bonds are lodged with RBOL. It is one thing allowing tenants to sublet part of their rental property. The sub-tenant is often at the mercy of a head tenant; who has no idea of their obligations. Head tenants who sub-let out properties have become landlords / agents. Head tenants need to complete a CPD course before they can sub-let. It should be mandatory for all bonds collected by a head tenant be lodged with RBOL

- Ensure short term furnished rental properties meet the same quality and safety standards as hotels. Whilst not directly related to the residential rental market, the rise of AirBnB and other short term holiday accommodation premises has reduced the pool of residential properties in some areas. These properties are commercial rentals not residential rentals. Often an owner will throw in old furniture from their home and think job done. Theses holiday lettings are often located in rersidential strata unit buildings. These properties do not meet the fire safety standards noise standards or security standards of hotels; against which they are competing for market share. They do not necessarily have fire rated carpets, curtains and bedding, fire rated doors, back to base fire alarms, a 24/7 emergency repair service, noise proof floors, ceilings doors or walls. These issues impact on the comfort and safety of other occupants in the building – including tenants who in some buildings represent the majority of occupants.

Another Thing We Do

We act on behalf of an elderly client for whom we manage several investment properties. One of his properties required a new roof. The original roof was beyond repair. A new roof would come with lambs wool insulation and whirlybird. The result was a significant reduction in the temperature of the property in summer and added warmth in winter.

Not only have we assisted in maintaining his property but have added a great deal of value to his property. At the same time, we have added to the comfort of our tenants and reduced their cost of heating and cooling the property.

A win win situation for everyone.

We would like to thank and recommend our tradesman Benny’s Roofing, who completed the work in 3-days. On time and on budget!

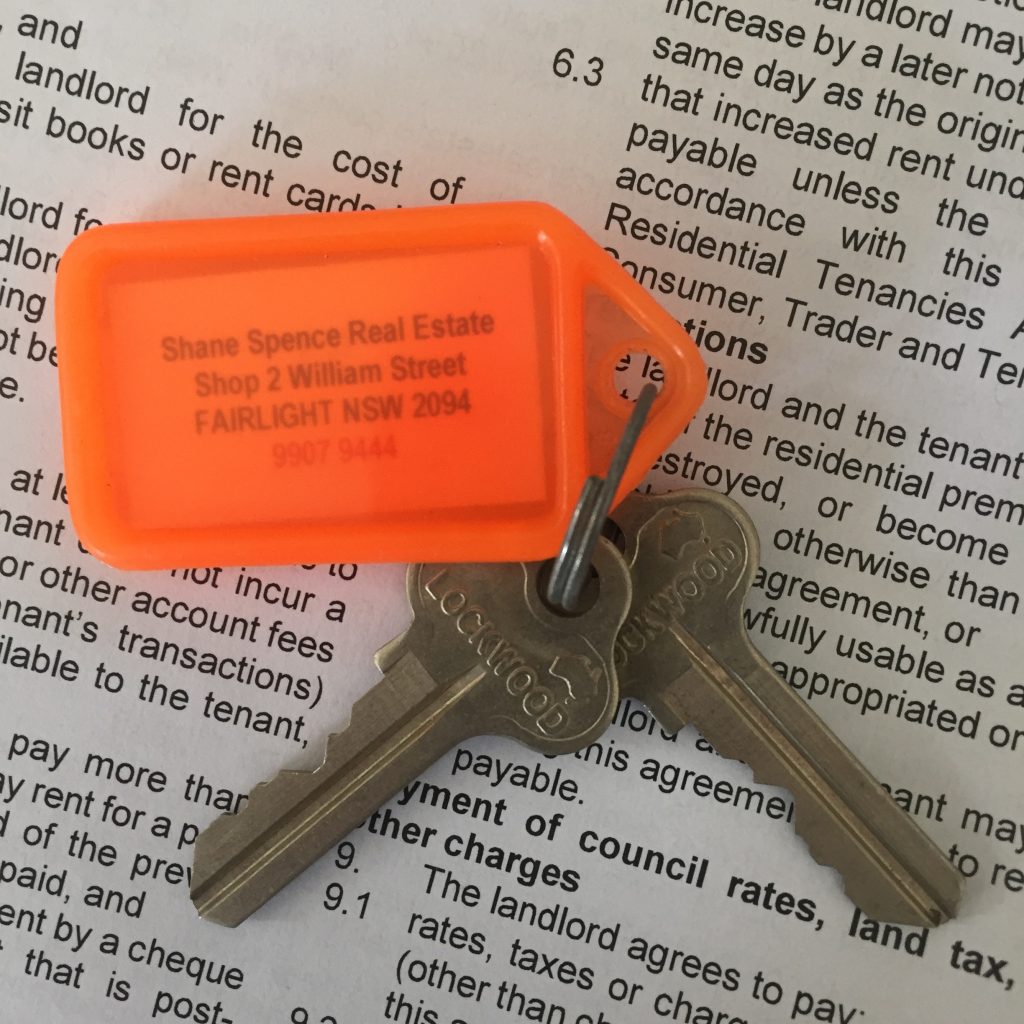

Shane Spence Real Estate is celebrating 21 years of operation from their Fairlight suite. We are specialists in sales and property management. If you need the services of a fully qualified real estate agent with over 30-years of experience on the Northern Beaches, call Shane on 0412 226 722 or email shane@shanespencerealestate.com.au

Another Thing We Do

Many people think that as a real estate agent, you just sell properties or collect the rent! As if that wasn’t enough in itself.

What we do is to maximise the value of our clients property.

Here is an example:

This delightful 1940’s P&O style duplex in Fairlight, was built by the clients parents. The windows are original and despite some effort to maintain them, they have progressively become worse over time. The client is a stickler for maintaining the property in its original art deco style.

With the assistance of our carpenter Aaron Peachey of AJP Building & Maintenance and our painter Victor Cirera, we have arranged for new timber sliding and sach windows by Airlite Windows to be custom made, installed and painted. Thereby maintaining the integrity of the property.

Shane Spence Real Estate is celebrating 21 years of operation from their Fairlight suite and is a specialist in sales and property management. If you need the services of a fully qualified real estate agent with over 30-years of experience on the Northern Beaches, don’t fail to call Shane 0412 226 722 or email shane@shanespencerealestate.com.au

Cost Of Owning An Investment Property?

For every dollar of rent collected an investor should assume that around 30% of that income should be set aside for running the property. Considering a typical 2-bedroom unit, which might lease in the local area for say $650 PW or $33,892 PA, you might expect to spend

| Repairs | $ 550.00 | 1.6 % |

| Insurance | $ 316.00 | 0.9 % |

| Council Rates | $ 1,365.00 | 4.0 % |

| Water Rates | $ 688.00 | 2.0 % |

| Strata Levies | $ 4,000.00 | 11.8 % |

| Agents Fees | $ 2609.70 | 7.7 % |

Add to this the unexpected and the routine renovation. Expect every 10-years to be installing a new hot water system at $1,200 to $1,800 ($150.00 PA); every 10 – 15 years, new floor coverings $3,500; paint $3,500, blinds $2,500, light fittings $800, ovens $1,200, dishwasher $900, cook tops $900 and range hoods $250 and you could be adding a further $1,150 PA or 3.5% to the cost of holding your investment.

Some Facts:

- All outgoings excluding interest & depreciation represent in excess of 30.0% of gross income.

- Whilst houses do not incur strata levies, the owner must incur all long term repair expenses such as replacing rooves, broken window panes, pest inspections and pest treatments for termites, maintenance of lawns, gardens and swimming pools, upgrades to electrical services, blocked sewers, fences etc, which over time equate to the cost of strata levies.

- One week of vacancy represents 1.9% income loss

- Gross rental returns currently average in the order of 3.5% PA however varied from as low as 2.5% for houses in high priced areas.

- Most expenses are relatively inflexible and cannot be adjusted according to the rental value of a property

- Major renovations of $15,000 to $75,000 to up grading kitchens, bathrooms, floor coverings, paint and other fittings. The gross rental return on these capital items ranged from 12 – 20% PA before depreciation. In comparison, the cost of borrowing money to complete these renovations is in the order of 7.0% PA.

These costs do not include the cost of borrowings, the cost of an accountant to complete your tax returns

Tips For Landlords

How To Increase The Value Of Your Rental Property

Some landlords try to go it alone on the management of their investment properties. Some succeed, whilst others don’t. Many DIY landlords end up in the NSW Consumer & Tenancy Tribunal NCAT. They suffer lost rents or damage to their investment property. Lost money is often never recovered from tenants or paid by insurance companies as a result of lack or procedure or foresight.

I like to compare it to completing repairs on your own car. If you have the time, skills, tools and inclination to repair your own car, great go right ahead. When your brakes fail as you are going down a hill however, it is too late to call in the mechanic.

Don’t be part of the problem but be part of the solution.

Successful real estate agents ensure they are not just another cost but that they are actively contributing to increasing the rental returns for their landlords.

Great agents attract great tenants, who pay great rents to live in great properties. Great agents encourage great landlords to maintain great properties which, attract great rents and achieve great rental returns!

Don’t Be The Biggest Loser.

The biggest loss a landlord will ever incur is the loss of rent due to a vacancy. The second biggest loss is the loss of rent due to rents not achieving full market price due to a lack of maintenance and presentation. Not rented or rented under value result in a reduced rental return, which will never be regained.

Poorly presented and maintained properties remain on the market for longer; achieve lower rents; are vacated more often, and; require more repairs more often than do properly maintained and renovated properties. Tenants respect a property more when it is handed to them in good condition. If the landlord cares, so does the tenant. If the landlord doesn’t care, neither does the tenant.

In the rental market for the Northern Beaches many tenants are paying in excess of $35,000 per annum in rent for a 2-bedroom unit. In excess of $75,000 per annum for a 3-4 bedroom house; that is after tax dollars. This is one of the highest valued rental areas in Australia. Tenants come from a high socio-economic backgrounds. They are young professionals or high income singles seeking a beaches lifestyle and an easy commute to Sydney’s CBD. They demand exceptional properties and yet all too often they struggle to find properties presented to a level, which would reflect the rents demanded.

It is not just the tenants however who miss out. Landlords who refuse to grasp the opportunity available to them also miss out on lost rents.

A property vacant for an additional 2 weeks every second year and achieving just $20 per week less in rent, costs the owner in the order of $1,700 per annum.

Doing basic maths, the expenditure of around $20,000 (which will pay for a new kitchen, paint and floor coverings on most 2-bedroom units) will return a before tax return of in the order of 13%PA. Compare that to the 3.5% PA gross rental return most landlord achieve on the remainder of their property or the 6.0% it might cost to borrow money to complete repairs. It is a no-brainer!

Land Tax Is Paid On The Value Of Land.

In NSW the state government levies a tax based on the value of land, which is not your primary residence. There exists a threshold level below which tax is not paid; meaning that for most single property investors, who have invested in one strata title unit, the value of the land falls below the threshold. For those investors who have purchase a single residential dwelling (house) the land value will almost immediately exceed the threshold; which in 2018 is set at $629,000 above which the owner pays $100 plus 1.6% up to the premium threshold of $3,846,000 after which another formula sets in.

This tax is paid on the cumulative value of all land any one individual owns in NSW (the family home is excluded from the calculation). The calculation excludes the value of any dwellings or improvements on the land; it is purely the value of the land, which is taken into consideration.

Land Tax Not House Tax

A 2-bedroom beach side cottage might seem a delightful investment to own and hold for future redevelopment or retirement. It will be easily leased at a fair and reasonable rent. A tenant however will base their opinion of the rental value on what the dwelling has to offer. They may pay a slight premium for a generous back yard in a good position however market forces will probably mean they will never pay the landlord the true cost of holding this property. It is not inconceivable for a property of this type to attract Land Tax of in the order of $12,000PA i.e. $230 per week. On a property, which might attract a rent of in the order of $1,000 – 1,200 per week, this is a major impost on the rental returns achievable.

Shane Spence is the principal of Shane Spence Real Estate at Fairlight since 1997 and services Manly and the local Northern Beaches area. Shane can be contacted on 0412 226 722 or shanespence.re@bigpond.com. For more details go to https://www.shanespencerealestate.com.au.

The information contained in this article is of a general nature only and does not relate to any particular property. The views expressed in this article are those of the author who is a fully licensed real estate agent however these views should not be construed to be a valuation nor should they be construed to be financial advice. Interested parties, should make their own independent enquires and seek the services of professional financial advisers.

Carbon Monoxide – The Silent Killer

Reproduced from an email sent by Bell Contracting

The cold snap has definitely hit Sydney and its set to stay for the next few days.

With this colder weather settling in, many people often dust off the cobwebs and bring out their room heaters.

Last week was Carbon Monoxide Awareness week, which aims to raise awareness of carbon monoxide poisoning across Australia and to advise on preventative measures that people can take to reduce the risk.

Half of Australian households are at risk from the effects of Carbon monoxide and they don’t even know it.

What Is Carbon Monoxide?

It is a toxic gas with fumes impossible to see, taste or smell. It is often referred to as the “silent killer” as its effects can be deadly and you can die from inhalation before you are even aware of it.

How Is It Produced?

Carbon monoxide (CO) is produced by the incomplete burning of various fuels, including coal, wood, charcoal, oil, kerosene, propane, and natural gas.

Who Is At Risk From Carbon Monoxide?

All people and animals are at risk for CO poisoning. Certain groups such as pregnant women, unborn babies, children, the elderly and people with chronic heart disease, anemia, or respiratory problems are more susceptible to its effects.

Which Domestic Appliances Can Produce Carbon Monoxide?

Any appliances that use gas, oil, kerosene, or wood can produce carbon monoxide. The most common fuel burning appliances that can produce carbon monoxide around the home are:

- Gas Space Heaters

- Gas Wall Furnaces

- Gas Central Heating Systems

- Gas Decorative Log Fires

- Gas Hot Water Heater Service

- Gas or Wood Stoves & Ovens

- Wood Heaters

- Gas Refrigerators

- Charcoal/Wood grills

- LP Gas BBQ

- Portable Camping Gas Stove (Butane/LPG)

- Gas Patio Heaters

- Gas or Petrol Driven Generators

- Motor Vehicles

Operating these appliances in poorly vented or enclosed spaces or where vents, chimney and flue-pipes are blocked can increase the chances of carbon monoxide being produced.

Danger signs to look out for around gas and other fuel-burning appliances include:

- Sooting, yellow or brown staining on or around walls, ceiling or below the appliance.

- Excessive condensation in the room where the appliance is installed.

- Lazy yellow or orange coloured gas flame, rather than a sharp blue one Note: gas log fires have yellow flames for a decorative effect.

- Pilot lights that frequently blow out.

- Peeling paint above the appliance.

- Sooting flecks on the ground and underneath appliance.

Symptoms

Knowing what to look out for is the first step in combating carbon monoxide poisoning. Carbon monoxide causes mild effects that are often mistaken for the flu. They include:

- Headaches

- Dizziness

- Nausea

- Breathlessness

- Fatigue

- Visual problems

- Pains in the chest or stomach

- Disorientation

- Erratic behaviour

- Collapse

- Loss of consciousness

Only a licensed gas fitter should test, inspect and service your gas appliance. Call our office today on 1800 80 99 77 to schedule in a service of your gas appliance. Servicing your gas appliance not only saves you money… It could save your life.

From The Team At Bell Contracting

All information was sourced and can be found on the Chase & Tyler Foundation website. https://www.chaseandtyler.org.au/

Freshwater Real Estate

Freshwater Property Report

Compiled with the assistance of information taken from RP Data Pty Ltd

Formerly known as Harbord, Freshwater is approximately 2 square kilometres in size. Bordered on the East by the Tasman Sea, south by Queenscliff and Manly Lagoon, West by Nolan Reserve and to the North by South Curl Curl.

Local Facilities

Freshwater has five parks covering nearly 9% of total area plus Freshwater Beach which is widely recognised as being one of the best local surf beaches as well as being one of the most family friendly beaches. Behind the beach is a large reserve area popular for family gatherings, BBQ’s. Pilu, Harbord Beach Hotel and the newly rebuilt Harbord Diggers Clubs are just some of the many quality eateries, cafes and bars located in the area. The people of Freshwater describe their suburb as a village which is the immediate impression one gets when visiting this area.

Demographics

The population of Freshwater in 2006 was 8,404 people. By 2011 the population was 8,252 showing a population decline of 1.8% in the area during that time. At the current time, there are a number of new developments under construction in Freshwater, which will see the population growing slightly in size; most notably the redevelopment of the Harbord Diggers site and two new developments n the Freshwater business district.

The predominant age group in Freshwater is 25-34 years. Households in Freshwater are primarily couples with children and are likely to be repaying over $4,000 per month on mortgage repayments. The local Harbord Public School has recently been expanded to accommodate a growing school age population.

In general, people in Freshwater work in a professional occupation. In 2011, 62.4% of dwellings in Freshwater are owner occupied. As at November 2017, the median sales price of a house in Freshwater reached a peak at that time of $2,630,000. For a unit the median price was $865,000, slightly down from the peak price in June 2017 of $882,000.

Sales

The number of houses being sold in Freshwater in 2017 was significantly down from previous periods. No doubt this shortage of supply has contributed in part to the significant increase in house values in the area.

Year No Sold Change No. Sold Change

2008-2017 Houses Median Price Units Median Price

Nov 2017 58 36.62% 152 11.97%

Nov 2016 74 -2.56% 153 10.28%

Nov 2015 80 25.03% 149 15.02%

Nov 2014 68 22.01% 141 17.12%

Nov 2013 94 2.37% 171 4.00%

Nov 2012 67 5.42% 164 -1.96%

Nov 2011 89 -11.15% 155 3.71%

Nov 2010 90 19.66% 166 13.05%

Nov 2009 86 8.48% 183 3.94%

Nov 2008 84 2.77% 124 1.03%

Your Local Real Estate Agent

Shane Spence has been the licensee in charge of Bower Real Estate Pty Ltd trading as Shane Spence Real Estate since May 1997. Shane is widely recognised as being a leading sales and auction specialist as well as managing a highly efficient property management portfolio on behalf of his clients. In the event you are thinking about buying, selling or leasing real estate in the Freshwater area, do not hesitate to contact Shane on 0412 226 722, or email shane@shanespencerealestate.com.au.

Disclaimer: Whilst all reasonable effort is made to ensure the information in this publication is current, neither Bower Real Estate Pty Ltd or CoreLogic warrants the accuracy or completeness of the data and information contained herein and to the full extent not prohibited by law excludes all for any loss or damage arising in connection with the data and information contained in this publication.

Contains property sales information provided under licence from the Land and Property Information (“LPI”). RP Data Pty Ltd trading as CoreLogic is authorised as a Property Sales Information provider by the LPI.

Are You Inside The Tent

Many people misunderstand what it is a real estate agent does. Most people would say agents sell real estate. Unless they happens to be the Vendor, agents are not selling real estate for a living. If that was the case, that would make the person a real estate trader.

Real estate agents market and negotiate the sale of other people’s properties; the only commodities they sell are their marketing and negotiating skills and services.

Whilst this is a pedantic distinction it is important as the use of language often requires exacting use of words. This however is not the subject at hand, which is to discuss if as a real estate buyer, you understand if you are inside or outside the tent!

One of the most difficult things to achieve when negotiating a sale is to encourage people to step across the threshold and make a meaningful offer on a property. It is easy enough to solicit a low bid. This however would be of no interest to a vendor and does not help to move two parties close to the point where they can make a deal.

There are several techniques which, can be employed to elicit a meaningful first offer.

The most common method is to sell the property by Public Auction. Public Auctions are about setting deadlines by which time buyers and vendors need to make firm decisions. For this method to work, it is imperative that the auction process is allowed to run its full course. There is a tendency in the industry to encourage offers prior to auction day. This diminishes the transparency of a “Public Auction” and prevents all potential purchasers having the same opportunity to meet the advertised deadline.

Sometimes Public Auctions do not achieve the desired result. Properties which, do not sell at auction need to go to the next level of marketing. Whilst on Sydney’s Northern Beaches auctions represent a sizable proportion of property sales, there remains a significant number of properties which are sold by Private Treaty.

There is a clue as to the negotiation process in the name of each method of sale. Public Auction is a relatively public, open and transparent process. Private Treaty, demands a level of private negotiation techniques.

The problem when negotiating by Private Treaty becomes how to elicit a meaningful first offer. Many buyers, particularly in a down market will sit and wait, or open with unacceptable low offers.

We need to consider if potential buyers are inside or outside the tent. The tent is the place in which negotiations occur. You are only inside the tent if you are participating in meaningful negotiations. i.e. you have made an offer and are actively pursuing the property within the vendors price guide. If you are sitting and waiting to see what happens you are outside the tent. You are not privy to what is actually happening in the negotiation process.

Many potential buyers ask to be kept informed in the event there are any offers made; these people are sitting outside the tent.

A buyer outside the tent should never be advised of other people’s Private Treaty offers.

Other active participants who have made a private offer, deserve the right to their privacy. Remember it is called a Private Treaty sale. Only once you have stepped inside the tent do you earn any right of knowing other peoples offers. Once inside the tent, your privacy is protected from those sitting outside. Only those already inside the tent or those who may subsequently come inside are privileged to know what other people have offered.

The counter argument is to ask, “why wouldn’t an agent shop around an offer to other interested parties in order to see what else could be achieved”. By promising everyone full disclosure, means no one will be encouraged to make a first offer. Everyone will sit and wait for someone else to make a first offer. Just like Penguins sitting on an iceberg surrounded by Orcas. Every Penguin waits for another to jump in to see just how hungry are the Orcas.

Secondly, touting offers does not respect the privacy of the person who makes the first offer in good faith. That act needs to be respected. Finally, if other people are to subsequent make offers off the back of some else’s effort, chances are they will only make marginally better offers, resulting in a tenuous quasi auction process.

Everyone needs to consider what the property is worth to them and make their first offer based on their own judgement.

Shane Spence is the principal of Shane Spence Real Estate at Fairlight since 1997 and services Balgowlah and the local Northern Beaches area. Shane can be contacted on 0412 226 722 or shane@shanespencerealestate.com.au For more details go to https://www.shanespencerealestate.com.au

#Agent #sales #auction #rent #Manly #Fairlight

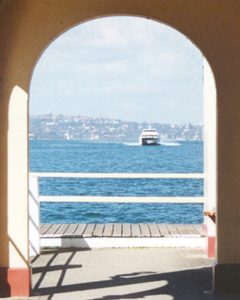

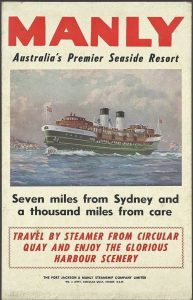

Manly, NSW 2095

Manly seven miles from Sydney and 1,000 miles from care

The most famous line about Manly, NSW was coined by the Port Jackson and Manly Steamship Company as a promotion for the seaside village of Manly. “Seven miles from Sydney and 1,000 miles from care” is as true today as it was then. Where in the world can you commute to a major CBD by a fast & efficient ferry service; then return home in the evenings and live beside one of the best surf beaches in the world, enjoy splendid harbour side walks through National Parks, dine out at first class cafes and restaurants and enjoy the excitement of international level sports events. One place, Manly.

Of all the international visitors who travel to Sydney it is estimated that 30% visit Manly for either an overnight stay or a daytrip. The average number of international visitors to Manly over the past three years was 828,200 per annum. Most arriving by ferry.

Manly, postcode 2095, is approximately 6 square kilometres. It has thirteen parks covering nearly 17% of the total area; is bound by the Tasman Sea to the East and Sydney Harbour to the South and West. Swimmers, surfers or sun worshippers can find their choice of nine major beaches and many other patches of ocean or harbour sand. Some beaches are surrounded by National Parks; some are only accessible by water; one has a clear fresh waterfall and all are picturesque.

Manly’s European history dates back to the first settlement. Shortly after the arrival of the First Fleet, Governor Phillip famously came to a cove and on sighting indigenous locals commented on their “manly” appearance. Not long after one of those manly natives threw a spear at Phillip who suffered a non-fatal injury. Ouch! Obviously, the original inhabitants occupied the area for many years prior to European settlement. Rock carvings, middens and other signs of an earlier Aboriginal culture can be readily found around the area. Sydney Road, which is the main thoroughfare into Manly, follows roughly the same path as a local Aboriginal track.

Manly, A Great Place To Live & Work

What a place to live in or work at. Manly is well serviced with public facilities, including: three primary schools (one public, one Catholic and one Montessori) two Catholic High Schools, as well as the International School of Management located on North Head; Manly Hospital; the Far West Home; Australian Institute of Police Management; Quarantine Station; North Head Sewerage Treatment Works; Bear Cottage; 3 Surf Life Saving Clubs (Manly, North Steyne and Queenscliff); Manly Marlins Rugby Club; Manly Golf Club; the newly expanded Boy Charlton Swim Centre; Manly Sea Life Sanctuary; Manly Art Gallery & Museum; Manly Wharf; Manly Local Court; Manly Library; Manly Police Station and until recently the Manly Council Cambers, which now form part of the greater Northern Beaches Council. With an active retail shopping centre complimented by the nearby Stockland shopping centre in Balgowlah and much larger Warringah Mall in Brookvale. A large and diverse restaurant, café and entertainment district serving the local and Northern Beaches area, with a wide variety of foods on offer from around the world and live music venues.

Young Hip & Ready To Spend

The population of Manly in 2011 was 15,079 showing a population growth of 8% over the previous 5-years. Quite a significant increase for a suburb with few opportunities for new land sub-division. Manly has in the order of 1,600 houses and 7,900 unit. Approximately 55% of all residential properties in Manly are held as investment properties; the predominant age group in Manly is 25-34 years. Households in Manly are predominantly childless couples and are likely to be repaying over $4,000 per month on mortgage repayments or paying in the order of $3,200 per month in rent. These young professionals tend to work in Sydney’ CBD but have made Manly home in order to enjoy a beachside lifestyle. They have high disposable incomes and in terms of the quality of housing, have high expectations, whether they intend to buy or lease their residence.

At time of writing (March 2017) the median sales price of houses in the area is $3,070,000, whilst the median price for units is $1,460,000.

Can We Be Of Service

Shane Spence of Shane Spence Real Estate has been a real estate agent living and working in the Manly, Fairlight & Northern Beaches area for over 25 years. Shane has a vast wealth of local knowledge and expertise in marketing and negotiating both sales and managing properties for lease. If you are looking to move into the area, are thinking of selling or have a friend or family member requiring the services of an experienced agency, feel free to contact Shane for a confidential discussion regarding your needs.

2017 Property Market Predictions

Dr Andrew Wilson Chief Economist for Domain writes:

What’s around the corner in 2017 for your city?

With the festive season fast approaching, making a move might find its way onto your list of New Year’s resolutions. 2017 could be your year to secure your dream home or finally make that big sale.

Whether you’re a buyer, investor or seller, 2017 provides opportunity for you.

The forecast for capital city housing markets remains mixed for 2017, with no surprise that Sydney and Melbourne are likely to continue to lead. It is likely that other capitals will remain steady, with price growth generally constrained by low income economies. Lower interest rates in 2017 are likely to continue to bolster housing markets, with an increasingly under-performing national economy almost certain to require further stimulus from the Reserve Bank. House price growth, although remaining positive in most capitals through 2017, will likely track in a narrow range of up to 5 percent annually for the top performers. The Darwin and Perth markets are set to bottom out in 2017, following a lengthy period of weak activity with prices at three year lows. A return to sustained growth for the Perth market, remains dependent on improvement in the local economy.

Unit markets will continue to be influenced by significant levels of new apartments, acting to push supply ahead of demand. The impact on local prices will vary, so keep your eyes out for a bargain on the unit market. The Sydney unit market is set to remain strong, due to a chronic under-supply of units and solid demand, holding prices strong.

This makes 2017 a great time for Sydney sellers.

Record new apartment supply in the Melbourne CBD will continue to outstrip demand, with downward pressure on prices to continue in that submarket. Strong demand and lack of supply for suburban units, however, will offset the weaker CBD market. This means that overall Melbourne unit prices growth is likely to remain positive over the year. If you’ve ever considered selling up and moving to the CBD, 2017 may be your time.

For the full report go to:

https://static.domain.com.au/domainblog/uploads/2016/12/14102606/2017PropertyMarketPredictions.pdf

Recent Comments